This article was originally published on www.display-central.com.

Everyone knows the 3D industry has had a bumpy history that dates back almost a century now. Perhaps the most famous “bump” was in the 1950s when 3D took the movie business by storm, but only very briefly.

3D for entertainment applications seems to be undergoing a similar bump right now. For example, the BBC announced it was going to suspend production of 3D content for a period of 3 years. This doesn’t mean there won’t be any 3D TV in Britain, or even any new 3D content available. It’s just the 3D content won’t be coming from the BBC. For British 3D TV junkies, Sky TV and Virgin Media have announced plans to take up at least some of the slack. In the US, the situation is similar, with ESPN announcing it will end production of 3D sports at the end of 2013, even after winning an Emmy award for 3D coverage of the X Games. Unfortunately, awards don’t pay broadcaster’s bills, viewers and advertisers do, and people are just not watching enough 3D TV.

An article in the New York Times paints a similar, but not as extreme, picture for the 3D movie industry. The number of 3D movie screens is up, 15,000 at the end of last year, compared to about one-quarter that in 2009. But the economics of those screens isn’t good. RealD, the biggest provider of 3D technology to movie theaters in the US, showed a loss for the first quarter compared to a profit a year earlier, even while signing a deal for 700 new screens over 10 years with Cinemax, Mexico’s largest exhibitor. Studios are still making 3D movies and viewers are still paying a premium to see them in 3D instead of 2D, but the numbers are down. 3D revenues for some summer “Blockbusters” are shown in the table.

| Movie | Opening Box Office | % of Box Office from 3D |

| Turbo | $21.3M | 25% |

| The Wolverine | $53.1M | 30% |

| Monsters University | $82M | 31% |

| World War Z | $65M | 34% |

|

Source: The Wrap, compiled by Insight Media |

||

“3D attach rates in the 30-35 percent range that were previously reserved only for the animated genre have now become more of the norm for action/superhero movies – which indicates that the 3D choosiness of consumers has become increasingly pervasive throughout more genres,” Eric Wold, an analyst at B. Riley & Co, wrote. 3D revenue more typically would be 40% for these movies and sometimes has been as high as 60%.

This disappointing box office is not just individual movies, but is across the board. According to the IHS research firm, receipts from 3-D ticket sales at the North American box office fell 13.1% in the first half of 2013, to about $1.05 billion, from $1.21 billion in the year-earlier period.

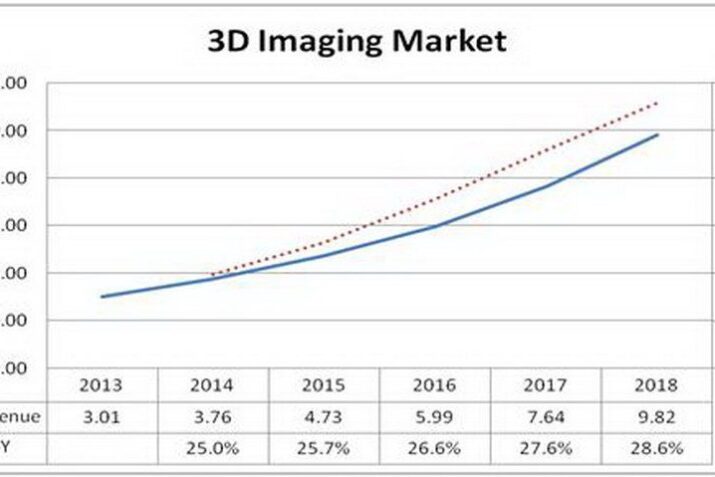

Professional applications are, perhaps, the bright spot in 3D. Applications such as virtual prototyping can save significant amounts of money compared to building real prototypes, and virtual prototyping requires 3D. Typically, very high-resolution 3D. Data on this market is less widely available and there is no “Opening Weekend” for a 3D installation at a major car company. But these markets are growing, and according to a report from MarketsandMarkets, will continue to grow.

This report, and the figure from the report, covers more than just the 3D display. It also covers 3D Modeling, 3D Scanning, 3D rendering, Layout and Animation, and Image Reconstruction, not just stereoscopic 3D displays.

While 3D TV broadcast may be a failure and 3D cinema may be leveling off at a new but lower plateau, it’s nice to see professional 3D applications may take up some of the slack. Of course, everyone has seen forecasts that say “3D will take off—next year. Not this year.” Hopefully the MarketsandMarkets forecast isn’t of this type. –Matthew Brennesholtz