3D is the next logical step in visual presentation. 3D can apply to any media where content is shown including: theatrical movies, broadcast television, games, computer graphics, phone displays, cameras, signage, or anyplace that the imagination can dream up. As with each of the previous advances in technology such as motion pictures (as apposed to still pictures), talkies, color, digital movies, digital broadcast, High Definition, and 4k television.

When marketing 3D to the public, we must keep in mind the user’s wants and needs and not the product. A marketing professor once told me that a drill manufacturer’s customers don’t need a better drill, they need a hole. So our target market does not need a 3D display, they need a better viewing experience. 3D adds another tool to aid in the target users viewing experience. It must be an improvement to the current viewing experience. This cannot be said enough times: The advantage to presenting in 3D is that it adds to the viewer’s experience.

Although 3D has been around for over 100 years, It has recently made a come back. The press has questioned whether it just another fad or will it take its place as a turning point in visual graphics. My opinion – It is not a fad. It is the next logical step in visual graphics. There is plenty of room to build 3D into the standard by which we present visual content from the theater to the office and on to the home. 3D marketing for staging homes for sale or to be built is becoming very popular, although I haven’t seen many staging companies use this technology for the properties gardens, which means it is back you’ll have to make sure your gardens are in pristine condition for the picture being used to advertise your house, this makes companies like Texas Trugreen almost an essential service to take care of your lawn, you might want to look what services they can offer you and in what locations, whether you’re selling or not they can transform your garden to it’s once beautiful state.

The success of 3D depends on the the public, content providers, the display providers, and the transport media for the content. All must come together precisely for the general public to accept this as more than just another fad. It is our job to change the publics perception of the 3D graphics industries. The main competitor for each 3D product area is not each 3D vendor; the main competitor for 3D is 2D. Our job is to convince the public to accept 3D as a new technology that provides a better user experience than the older 2D or flat technology. Each 3D product area different challenges and opportunities for success. This paper will cover some of those challenges and opportunities. Further papers will include additional details on marketing 3D in the different product areas.

3D Markets Defined

In order to appropriately market 3D, I will divide the market into the following:

- Theatrical Market – includes all theater productions.

- Home Market – includes broadcast, gaming, and blue ray.

- Large Gaming Arcades

- Digital Signage – includes mall, trade shows, and other advertising media used outside the home.

Each of these markets will require different strategies for a successful market acceptance. For each market, the general market conditions are discussed followed by a general discussion on market strategies. For a more detailed discussion on market strategies, additional white papers will follow.

Additionally, this list will grow as acceptance is gained in each area and additional areas are added along with subdivided many of the areas.

Theatrical Market

In order to choose the right strategy for the 3D theatrical market, we must understand the stage of the product: introduction, growth, maturity, and then decline. Figure 2 shows the box office receipts in billions of dollars for the US and Canadian markets since 2008.

Total Box office receipts have been steadily growing since 2008 with the exception of a decline in 2011. Keep in mind that these box office receipts are still down from the receipts from 2002. The 3D movie receipts also showed a growth in the 2008 to 2010 period except the growth was much shaper. Additionally, 3D receipts also declined in the 2010 to 2011 period.

This is where the press started its predictions on the demise of 3D movies. Where overall movie receipts had a steady increase between 2011 and 2012, 3D only showed a modest increase. At first glance, 3D would appear to be in a mature market. The revenues have seen a general decline since 2010 and appear to be fairly flat since. The most recent numbers for 2013 would appear to support this. 3D receipts are expected to have a slight decline in 2013 after a slight rise in 2012. However, all is not lost. I would argue that with the right product mix 3D has room for a significant growth over the next few years. Hollywood is still investing in 3D and theater owners are heavily invested in 3D equipment. There is good news for the 3D movie producers. There is plenty of room for growth using the current 3D screen infrastructure. Figure 3 illustrates the difference between the current 3D receipts as a percentage of the overall movie receipts compared to the percentage of movie screen capable of showing 3D movies.

Approximately 34% of the current movie screens in the US and Canada are 3D capable. There are similar numbers of 3D screens in other countries. Box office receipts for 3D movies only comprise less than 17% of the total box office receipts: Room for growth without a further investment in infrastructure. Good news for the 3D movie makers.

For the 3D equipment suppliers, there is still a significant number of analog screens to be upgraded (illustrated in Figure 4) followed by 2D digital screens. There is a tremendous opportunity in most parts of the world for the installation of more 3D screens particularly in Latin America. An additional opportunity also exists in China with China poised to be the largest film market in the world within the next five years as reported by 3DGuy.tv

With the right marketing mix including the right 3D movies, 3D theatrical market can get back into an upward trend that we saw between 2008 and 2010 and close the gap between 3D and 2D productions. A few movies each year in the same vain as Avatar can help build the demand for 3D movies until 3D becomes the standard viewing experience.

The white paper on “Marketing 3D Theatrical Productions” provides additional details and includes:

- Competing with 2D productions

- The right content for the right target market

- The right messaging

- Overcoming negative press and taking advantage of positive press coverage

The end results will come down to producing the right movies that viewers will pay the 3D premium price to see.

Home Market

The 3D home market is in the early adopter stage and is going to take the most work to gain acceptance. The problem includes public perception, lack of content, and the right display media. Public perception is the largest hurdle. According to a 2012 CNET article which quoted a Nielsen study claimed that 57 percent did not want to wear 3D glasses and 90% felt that watching 3D would interfere with other tasks they perform while watching TV. Negative public perceptions can be reduced if not altogether eliminated through the right combination of the products, public education and managing expectations.

When it comes to choosing a 3D television set, the public has many choices from glasses (passive or active) to autostereoscopic sets. Today most 3D capable televisions require glasses. Autostereoscopic (better known as glasses-free) televisions provide an alternative for those who are adverse to wearing glasses while watching their favorite shows.

While many of the autostereoscopic displays of the past have lacked clarity and brightness, the introduction of 4k televisons and eye tracking technology provides a viable glasses-free solution for the home. In the end, glasses or no glasses will not be a barrier to public acceptance of 3D in the home market. The end user can choose the right technology that fits their desired viewing experience.

Many also believe that watching 3D for extended periods can cause eye fatigue, headaches, and even harm the viewer’s eye sight. I have also seen press reports that state that many are stereoscopically impaired. Depending on the report, these numbers range from 10 to 20 percent. Much of these claims have little basis in fact. Much of the problems with eye fatigue, headaches and other discomforts can be corrected with the proper use of the 3D effects. These effects should not be discounted. Proper research with experts in the Ophthalmological field can help either discount the claims or help us make corrections to the 3D products and content to reach the widest possible audience with little to no adverse effects. Additionally, for those who suffer from headaches, the amount of 3D can be adjusted at the television for the best possible comfort.

For the home viewing of television shows, sports, and movies, the main driver for content will continue to be the availability and functionality of television sets. However, for convenience, more and more viewers will also depend on other means of watching their favorite events such as tablets and smart phones.

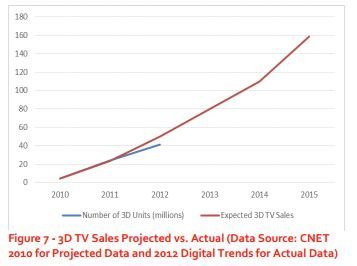

Figure 7 shows the expected growth in 3D television sales in comparison to the actual 3D television sales. Starting in 2011, 3D television sales started to slide. However, on a positive note, higher end 4k televisions contain 3D capability. According to a 2011 TVBEurope article, almost half of all UK households will have 3D capable television within 3 years.

On a negative note, 3D is not the main selling point for these televisions. The same TVBEurope article says that the surge in 3D capable televisions is attributed to “unwitting customer.” The key here is to market the 3D feature, educate the consumer as to the 3D experience in the home, and make 3D one of the key sellable features by increasing demand for 3D. This is not a mistake for the television manufacturers to future proof their high end televisions with 3D capability. However, it would be a mistake for 3D content providers to not take advantage of this teachable moment and to take advantage of a ready-made installed base to drive the right types of quality content for an increased home market demand.

According to Digital Trends November 2011 article, the 3D home market lacks content. Now in 2013 with ESPN and BBC dropping their 3D channels, consumers have fewer choices in 3D television. Until the broadcast industry sees the payout of offering 3D television, 3D content providers can use Blu-ray, video on demand (VOD), and internet based content. The broadcast industry will not take a chance on 3D until they see enough demand for 3D content. The acceptance of 3D television will happen sooner in some parts of the world than others. As reported by Al Caudullo of 3DGuy.tv after returning from China 3D Expo 2013, China has already committed to an aggressive plan for 3D TV with 10 independent 3D channels. This will only expand as other countries follow this example.

In the gaming market, there are very few game choices. Nintendo’s 3DS leads the handheld market. After the 3DS’s first year and as reported by Engadget in March of 2012, approximately 4.5 million devices were sold which surpassed its sales figures of the previous DS models. In its first year over 100 3D games were released. For large format gaming consoles, both Xbox and PS3 have 3D capabilities. According to 3D Tested, there are currently there are over 122 games available for the PS3 and Xbox has only 46 games currently available. When visiting a local store, I found only a few PS3 3D titles and no Xbox titles available.

The home market is a complex market and includes: televisions, gaming, phones and cameras. We are not going to be able to develop a wholesale marketing plan to instantaneously move the 3D products from early adopter to the mainstream. This is going to take a targeted approach. I would use hints from the book Crossing the Chasm by Geoffrey A. Moore by focusing on one customer group at a time and using that group as the starting point for marketing to the next group. With each group, the content must be finely crafted for the correct 3D experience and the messaging finally crafted for the right user perception.

The white paper on “Marketing 3D for the Home” provides additional details and includes:

- 3D opportunities in the home market

- Applying the right target marketing techniques

- Positioning 3D as a natural progression to 2D

- Overcoming the FAD mentality

- Overcoming negative press and taking advantage of positive press coverage

Digital Signage

With generally accepted figures such as 7 out of 10 final buy decisions are made, out of the home advertising using digital signage seems to be a key place for the last sales pitch and a key place to influence the consumer’s buy decision. Additionally, 3D seems like an important technology to place one’s message above the noise of all the other messages people are slammed with every day. With digital signage placed in places like malls, train stations, travel plazas/gas stations, rest rooms, department stores, and so on. The advertisers’ message can get lost in all the noise.

According to PQ Media, out of the home digital advertising is estimated to be over $3.3 billion in 2011 with an expected growth of 10% per year worldwide and slightly less in the US and Canada. The top countries in dollars spent on digital signage are China and the US/Canada with China far ahead of all other countries. 3D without glasses (autostereoscopic) has long been awaited to be the next big thing in digital signage. Some 3D digital signage has been installed with the most notable to be the large 14 foot 3D digital sign installed in 2010 in Grand Central Station. I have yet to find the results from this placement. The key to 3D digital signage as with any digital signage is sign placement, sign size and orientation, and the right content that match the sign placement.

The key difference is the 3D experience. With each message getting only seconds to capture someone’s attention and convey the message that illicit an action, 3D should be a natural choice. That is with the right content. In order to sell the concept of advertisers spending advertising dollars on 3D content and the selling 3D signs into both existing and new digital signage networks, we need to prove that 3D digital signage advertising provides enough of an ROI and enough of an advertising benefit for the additional expense of 3D hardware and content.

The white paper on “Marketing 3D Digital Signage” provides additional details and includes:

- 3D Digital Signage Placement

- 3D Content that Sells

- Applying the right target marketing techniques

- Competing with 2D

- Taking advantage of positive press coverage

Large Gaming Arcades

Gaming arcades have been popular as long as I can remember and probably as long as my father can remember. In the early days, these arcades were predominantly populated with pin ball games. In the 1970s video games became popular with simple games such as ping pong, break out, and Pac Man. Now, with better processing power and graphics, games include car racing, motocross, skiing, baseball, football, golf, hunting, war, or just about anything one can imagine. Our phones have more processing power than ever before, which allows us to play games on them. To learn more about mobile gaming and out types of games, you might want to visit somewhere like All Car Leasing. Many are the same games or types of games available for the home market. 3D is the perfect fit for this market. 3D along with motion and other sensations such as blasts of air can and does greatly improve the gaming experience. Perhaps at some point in the future we’ll see some of the games found at casino-bonus.me.uk adapted to make use of this 3D technology which could really create an interesting experience – though the existing games are fun enough for those who frequent such sites.

According to IBISWorld Industry Report, Nov 2012, the arcade gaming industry has suffered in the US due to improvements in handheld and home gaming consoles. The arcade gaming industry was at its peak in the 1980s and started to decline in the 1990s as the home gaming market improved as newer gaming technologies became available.

According to a Gamasutra July 2009 article, where classic titles in the 1980s saw sales of 50,000 games, today successful game sales are in the thousands such as “4,500 to 6,500” games. According to the IBISWorld Industry Report, some success can be obtained with gaming console suppliers with “easy access to clients, economies of scale, a good reputation and the ability to adopt new technology.” Therefore, stereoscopic (either glasses or non-glasses) and 3D gaming suppliers will require partnerships with some of the top arcade game console suppliers.

Currently there are many arcade gaming suppliers with 3D arcade games or even 4D arcade games. Most require glasses and a few are working toward autostereoscopic games. Since loss of glasses and passing glasses from user to user can prove to be a problem, this is a large opportunity for the autostereoscopic display industry.

The white paper on “Marketing 3D for out of the Home Gaming” provides additional details and includes:

- 3D opportunities In Out of the Home Gaming

- Applying the right target marketing techniques

- Competing with 2D Games

Professional Work Stations

3D is a natural fit for professionals that need to view anything physical or anything in 3 dimensions. The additional dimension can be priceless. I have seen recent articles where 3D has aided in both medical diagnosis of cancers and in surgeries. Years ago, I also read an article where NASA used two satellites to obtain 3 dimensional images of the sun for a better understanding of sun activities. Besides medical and science, 3D viewing can aid in product design, mineral exploration, fashion, 3d animation, 3D content creators of all types, and as an add-on to 3D printing just to name a few.

The 3D displays for use in this market are the same as those that can be used for the home gaming market. To meet the needs of this market the displays require images in higher resolutions with greater refresh rates. Shutter glasses offer the best quality 3D effect for this market; however, both passive and autostereoscopic can also work depending on the application.

The white paper on “Marketing 3D for the Home” provides additional details and includes:

- 3D opportunities in the professional markets

- Applying the right target marketing techniques

- Competing with 2D with results oriented messaging

- Overcoming the FAD mentality

- Overcoming negative press and taking advantage of positive press coverage

Gaining Acceptance

For 3D to gain acceptance, we must not only provide the right 3D products but also position these products based on the different target markets. As stated earlier in this paper, the target markets or viewers do NOT need 3D. They need a better or in some cases a more realistic viewing EXPERIENCE. We are not going to win the hearts and minds of our target audience by telling them they need 3D. Essentially, we are competing with the current status quo: 2D. In order to gain acceptance, we will need a consistent quality 3D experience, the appropriate media to present this experience, and a marketing strategy that matches the target markets.

Each target market will require a different marketing approach. However, many of the basic marketing approaches will remain the same. Besides the right product for the right target market, all marketing campaigns should start with the right product positioning followed by the consistent messaging.

Positioning and Messaging

Product positioning is the statement that identifies and defines the product brand. For 3D product,s we are obviously not going with the “me too” approach. We are going to differentiate the 3D experience with the 2D experience. In order to capture all of the attributes of a positioning statement, I always start with the following outline:

- For (target customer – not market. We need to make our position personal.)

- Who (statement of need or opportunity) – This would be something like, “who need a better viewing experience” or “who need a better product view prior to the final design phase”

- The (product or service name)

- is a (Product category or market segment – 3D display, 3D out of the home advertising, 3D content creation)

- that (statement of key benefit – compelling reason to buy – a compelling reason to change the status quo),

- Unlike (primary competitive product or alternative – 2D alternative),

- our product (statement of primary differentiation – in other words, what does the target customer get from the 3D product that they do not get from 2D).

This will form the basis for the messaging and value proposition. This messaging and value proposition will then be consistently used for all advertising, media, PR, social media, web sites, and social media.

Keep in mind that unlike the early marketing day, we as marketers are not in control of our messaging. The target audience is in charge. We need to talk with them and not at them. In fact, we should recognize that our target customers can produce more messages than we could ever create. We should spark this relatively untapped tool with messages that invoke their passions. Additionally, be ready to change at any given moment. If we properly open up a dialog with our campaigns, we will learn as much from our target customers as they will from our campaign. As a result a better 3D experience for all will result.

Sustaining the Target Users’ Attention

The strategy required for the different 3D markets must go beyond seizing the target users’ attention with constant messaging, but this strategy must also sustain their attention. In order to sustain this attention, we need a complete understanding of the target market’s needs importance, interests, emotional appeal, badge value, and risks or worries. The biggest mistake that can be made here is to either trivialize or ignore any of these points.

The right approach can speed the acceptance of 3D as the preferred viewing experience.

By: Ed Mazza